Succession Planning and Exit Strategies

Succession planning allows for the orderly transfer of ownership and management of your business, ensuring that your retirement goals become reality and that your business continues to flourish. Many business owners have a “warm and fuzzy” intention to transfer their business to their family members without establishing a concrete action plan, training plan, or even assessing their family member’s desire or ability to run the business.

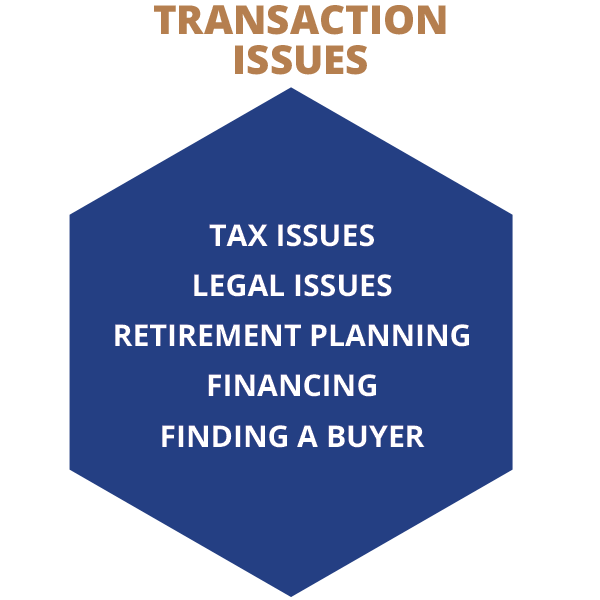

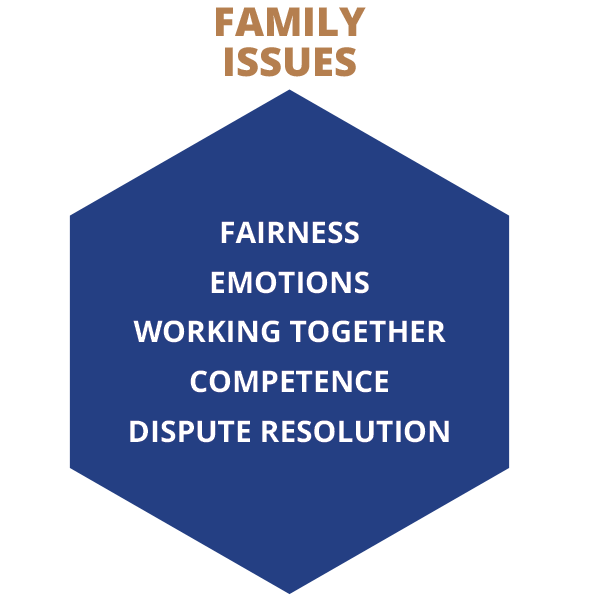

Handing the family business over to your children is complex and risky. Preparing it for an external sale is even riskier. Proper succession planning is complex, involving many different issues to consider:

In addition to a more successful transition, planning in advance lets you take advantage of significant tax savings that the government allows on the transition of private companies. While tax considerations shouldn’t drive all of your decisions, these creative tax structures and estate planning tools enable you to defer (or even avoid) significant amounts of taxes — if you plan early enough.

Beal Business Brokers & Advisors can assist you with your succession plan by:

- Identifying issues

- Determining value

- Finding ways to increase value

- Preparing the business for sale

A good exit plan can increase the value of your business by 30% or more. You should be planning now if you plan to exit your business within the next three to five years.

Contact us for more information.

Transition to the Next Generation

A family transition is the “traditional” model – a business is passed on from parents to children over the generations. A full 25 – 30% of businesses still pass on in this fashion. The advantages are very simple – the children typically learn the business from the ground up, and have had a part in the growth from the beginning. If they have been groomed to take over, they should have the skills and experience to run the business.

The risks, of course, are just as apparent – perhaps the children don’t want to take over, or perhaps they are not as capable as their parents. The sad reality is that only 10% of family businesses survive to the third generation. Other factors that need to be considered include:

- Valuation

- Fairness between children (both inside and outside the business)

- Roles and responsibilities between family members

- Tax issues

Beal Business Brokers & Advisors can help in management transitions in the following ways:

- Provide an independent view on value (needed for CRA purposes)

- Assist in deal structure

- Assist in negotiations – as an independent party

Contact us for more information.